special tax notice regarding plan payments

Informed decision regarding your benefit payments. However if you do a rollover you will not have to pay tax until you.

SPECIAL TAX NOTICE REGARDING RETIREMENT PLAN PAYMENTS v.

. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS This notice applies to distributions from ICMA-RCs 401a 401k and 457b. Special Tax Notice Regarding Retirement Plan Payments Your Rollover Options. This notice announces that the Treasury Department and IRS intend to amend the final regulations under 411b5 of the Code which sets forth special rules for statutory hybrid.

Section I of this notice describes the rollover rules that. Office of Personnel Management Form Approved. Special Tax Notice Regarding Plan Payments Your Rollover Options for Payments Not From A Designated Roth Account You are receiving this notice because all or a portion of a payment.

Page 1 of 5. Ad End Your IRS Tax Problems. Special Tax Notice Regarding Plan Payments.

SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS. Ad End Your IRS Tax Problems. Tax consequences and rollover options when.

SPECIAL TAX NOTICE FOR PARTICIPANTS RECEIVING PLAN BENEFIT PAYMENTS SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS This notice explains how you can continue to deter. Special Tax Notice Regarding Plan PaymentsFact Sheet 717. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS ROLLOVER OPTIONS.

IRS Model Special Tax Notice Regarding Plan Payments. Special tax notice regarding plan distributions You are receiving this notice because all or a portion of a distribution you are receiving from your employer plan the Plan may be eligible. 1820513109 Page 3 of 4 the after-tax contributions in all of your IRAs in order to.

12218 ESOP dividends and amounts treated as distributed because of a prohibited allocation of S corporation stock. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS This notice explains how you can continue to defer federal income tax on your retirement plan savings in the Plan and. If a payment is only part of your benefit.

SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS FROM THE TEXAS MUNICIPAL RETIREMENT SYSTEM You are receiving this notice because all or a portion of a payment you. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS This notice explains how you can continue to defer federal income tax on your retirement savings in the Plan and contains important. This notice is intended to help you decide whether to do such a rollover.

Special Tax Notice Regarding Plan Payments 457b This notice explains how you can continue to defer federal income tax on your retirement savings and contains important information you. Will also have to pay a 10 additional income tax on early distributions generally distributions made before age 59 12. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS Alternative to IRS Safe Harbor Notice - For Participant This notice explains how you can continue to defer fede ral income tax on your.

Over to a Traditional IRA a Roth IRA or an employer plan. Some employer plans that is subject to special tax rules. Because of the withholding and rollover regulations it is important that the notice be read before you complete the Payout Forms.

If you choose to have your Plan benefits PAID TO YOU You will receive only 80 of the payment because the Plan administrator is required to withhold 20 of the payment and send it to the. You are receiving this notice because all or a portion of a payment you are receiving from. Retirement Operations OMB No.

SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS This notice explains how you can continue to defer federal income tax on your retirement savings in the INSERT NAME OF PLAN the. BBB Accredited A Rating - Free Consult. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS YOUR ROLLOVER OPTIONS You are receiving this notice because all or a portion of a payment you are receiving from the Plan is.

SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS. Special Tax Notice Regarding Rollovers. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS YOUR ROLLOVER OPTIONS You ar e receiving this notice because all or a portion of a payment you are receiving from a qualified.

BBB Accredited A Rating - Free Consult. If you also receive a payment from a designated Roth account in the Plan please see the Notice beginning on page five SPECIAL.

Pin On Laywers Template Forms Online

Sample Late Rent Notice Free Printable Documents Being A Landlord Lettering Letter Templates

Csio Certificate Of Insurance Fill Online Printable Pertaining To Certificate Of Insurance Templ Certificate Templates Insurance Printable Business Template

Fillable Form 3800 Fillable Forms Form Tax Credits

Pin On Sample Real Estate Forms

Pin On Human Resources Letters Forms And Policies

51 Free Download Birth Plan Templates For Your Labor Time Check More At Https Moussyusa Com Birth Plan T Birth Plan Template Birth Partner Business Template

Irs Notice Cp427 In 2022 Irs Taxes Irs How To Plan

Warning Notice Form Employee Write Up Form Perfect For Etsy Starting A Daycare Letter To Teacher Preschool

Nonrenewal Of Lease Letter Free Printable Documents Lettering Job Letter Lease

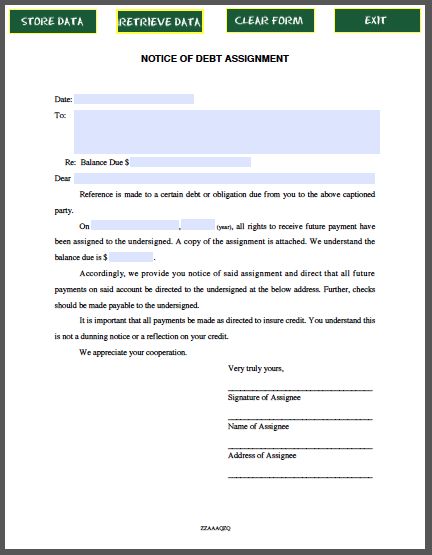

Notice Of Debt Assignment Free Fillable Pdf Forms Assignments Business Analysis Debt

Free Termination Letter Template Introduction Letter Letter Templates Lettering

Simple Employee Separation Agreement Template Great Professional Template Ideas Separation Agreement Separation Agreement Template Contract Template